What Exactly is Credit Repair?

Great discussion with the Lee Barrison, founder of Infinity Real Estate Group and Anselmo Moreno founder of Innovative Credit Solutions! Find out what exactly credit repair is really all about.

Great discussion with the Lee Barrison, founder of Infinity Real Estate Group and Anselmo Moreno founder of Innovative Credit Solutions! Find out what exactly credit repair is really all about.

Credit problems? Take action now, because your bad credit is not going to fix itself.

If you are an adult living in the United States, it is a pretty sure bet you have a credit report. It’s also a sure bet that you didn’t learn anything about credit reports and personal finance in school. Now, as an adult, you come face to face with your credit report – basically your adult report card. Are you happy with your grades? AKA your credit scores…

I have been a professional credit consultant for the last 12 years. I have seen consumers from all walks of life have bad credit. The reasons are plenty! A sudden job loss, divorce, bankruptcy, Identity theft, medical catastrophe or just plain old poor money management and overspending. Bad credit can be crippling to your overall financial success.

The one thing everybody who’s ever had bad credit has in common is: It’s not going to fix itself. Some of those consumers choose to ignore their bad credit and live the “I pay cash for everything” lifestyle. But let’s face it, they are not paying cash for their house or new car.

Other consumers choose to take action and become informed about how to credit really works. They research whether or not credit repair can be a good fit for them. As they master their credit score, they are welcomed into the 700 club. (A secret club composed of consumers with a 700+ credit score) 😉

Which one are you?

To join the 700 club, take action and visit www.bakersfieldcreditrepair.com/contact to schedule a time to speak to a professional credit consultant.

When an eager consumer doesn’t qualify for the financing they require, they often are advised to seek a qualified “co-signer” to allow them to obtain the loan or credit extension.

Financially, it’s like juggling knives with your eyes closed.

Four things you NEED to know:

Remember: It is a contract you are signing. You are promising that if anything goes wrong; you will pay the balance, plus interest and penalty fees.

If you already are a co-signer, you need to set some safeguards to protect your credit.

I cannot stress how important it is to pay the bill yourself to protect your good credit. There is a reason why they need a co-signer, and it is because they do not have a good track record of paying their bills on time.

The bank is already telling you that they do not trust that person enough to lend them the money without your guarantee.

I have seen it end friendships, relationships, and make family gatherings extra awkward.

Co-Sign at your own risk!

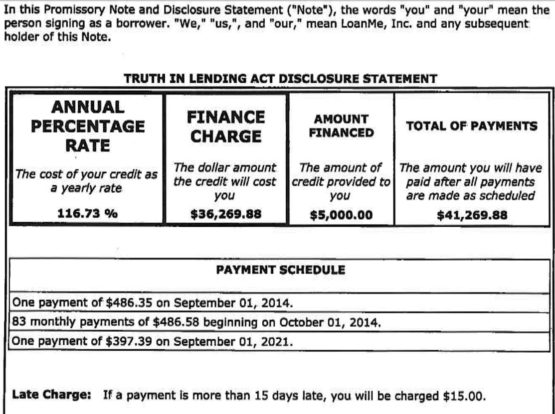

116.73% — Yikes! Today I had a consumer seek out advice regarding a recent court summons he received from an online lender that he borrowed $5,000 from. It was a fairly standard civil complaint for monies, until I saw the Truth In Lending Act Disclosure Statement. Check it out for yourself!

Is this the modern-day Mafia? At the end of the term the consumer would have paid back $41,269.88. Who in their right mind would take out this kind of loan?

That’s exactly the problem. Payday loans, title loans, online loans all are extremely predatory in nature and rely on a consumer who is in a serious financial bind in order to get them to accept these heinous terms. They are not in their right mind and will justify this quick money loan as a means to bridge their financial need immediately. Who’s thinking long-term when your fridge is broken? Your loved one just died? It’s predatory. Having bad credit leaves you with no choice but to deal with these types of lenders. Don’t live with bad credit. The cost of bad credit can be extreme…

Consider this: If you have great credit, you can easily borrow $5,000 at no interest or extremely low-interest. You can repay the loan quickly and not be on the hook for $41,269.88…one of the many benefits of having great credit. I help consumers take control of their credit reports and credit scores.

Do you need to repair your credit, settle debt, or just want to know where to start? You found the right place!

Have you ever been to the doctor or the emergency room and thought your insurance took care of the bill only to find out later through your credit report that it didn’t? In that case, the changes would directly benefit you.

On August 7th , 2014, FICO, the company behind the most commonly used credit scoring system, announced a new generation of its credit scoring formula with some remarkable changes to the way it assesses consumer credit risk. The new scoring system, known as FICO® Score 9, is designed to bypass the presence of paid collections.

Previous FICO score systems significantly lowered a consumer’s credit score if it detected any collection account on the credit report, paid or unpaid. In addition, the new scoring system also treats unpaid medical collections differently. FICO® Score 9 does not penalize a consumer as much for an unpaid medical collection as it normally does for other unpaid non-medical collections.

Since developing the first FICO credit bureau risk score in 1981, FICO has made several revisions to its credit score formulas that bring the system more in line with current trending consumer spending and payment habits. Thirty years ago, consumers didn’t use debit cards, nor was it a common practice to have rent-to-own furniture or access to credit at every single store in the mall. It is easy to see why updating your scoring system is necessary if you are in the credit risk management business. Read More ▸

Welcome to our new website!

Learn all about credit repair, credit reports, debt collections, and much more. Navigate our website to see credit repair client testimonials and visit our very active Facebook page: www.facebook.com/icscreditfix 🙂 and Google+ page: Credit Repair Bakersfield