“Quick” loans and bad credit….

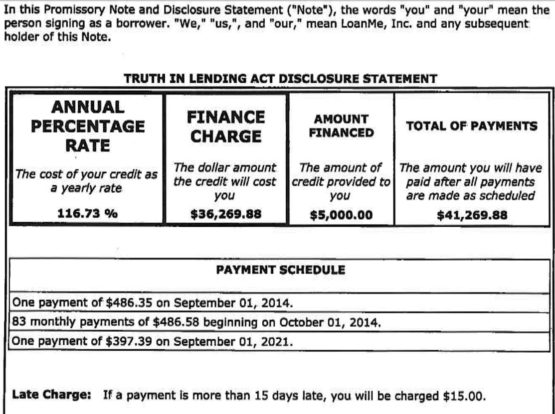

116.73% — Yikes! Today I had a consumer seek out advice regarding a recent court summons he received from an online lender that he borrowed $5,000 from. It was a fairly standard civil complaint for monies, until I saw the Truth In Lending Act Disclosure Statement. Check it out for yourself!

Is this the modern-day Mafia? At the end of the term the consumer would have paid back $41,269.88. Who in their right mind would take out this kind of loan?

That’s exactly the problem. Payday loans, title loans, online loans all are extremely predatory in nature and rely on a consumer who is in a serious financial bind in order to get them to accept these heinous terms. They are not in their right mind and will justify this quick money loan as a means to bridge their financial need immediately. Who’s thinking long-term when your fridge is broken? Your loved one just died? It’s predatory. Having bad credit leaves you with no choice but to deal with these types of lenders. Don’t live with bad credit. The cost of bad credit can be extreme…

Consider this: If you have great credit, you can easily borrow $5,000 at no interest or extremely low-interest. You can repay the loan quickly and not be on the hook for $41,269.88…one of the many benefits of having great credit. I help consumers take control of their credit reports and credit scores.

Do you need to repair your credit, settle debt, or just want to know where to start? You found the right place!